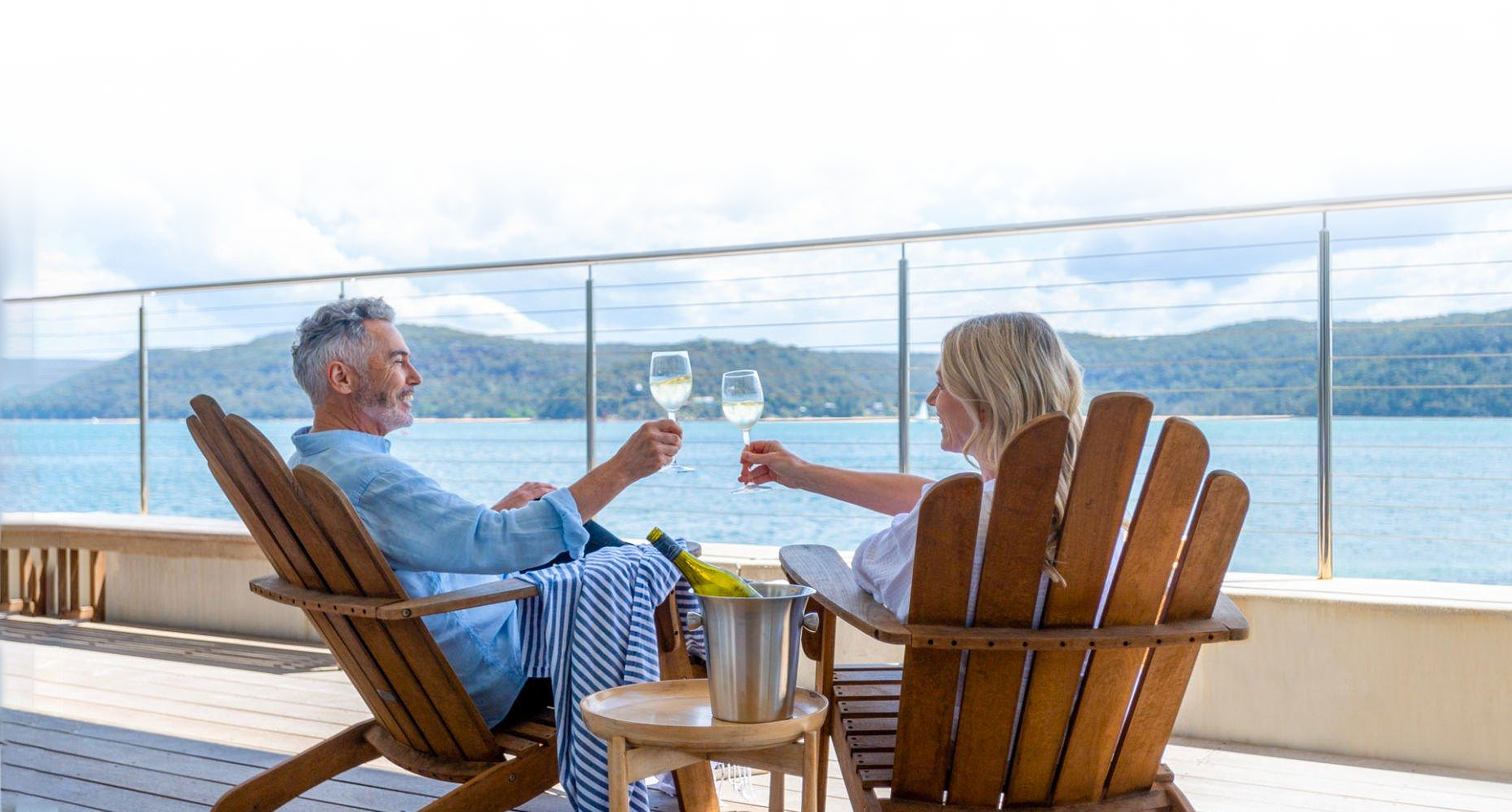

At Rosbotham Finance, we understand the unique challenges and opportunities of retirement planning in Switzerland. David and his team, work with you to develop a customised plan that aligns with your individual retirement goals, whether that’s retiring early, maintaining a certain lifestyle, or leaving a legacy for your family.

Our comprehensive approach to retirement planning takes into account all aspects of your financial situation, from investments and savings to Social Security benefits and healthcare costs. We work closely with you to develop a retirement plan that is realistic, achievable, and tailored to your needs.

At Rosbotham Finance, we believe that retirement planning is about more than just money. It’s about peace of mind, security, and the freedom to live the retirement you’ve always dreamed of. Let us help you achieve your retirement goals today.