Written by David Rosbotham DipPFS | Financial Planner

Switzerland, with its stunning landscapes, strong economy, and high quality of life, is a popular choice for expatriates looking to settle down. However, planning for retirement as an expat in Switzerland presents unique challenges and opportunities. Here, we’ll explore five crucial tips to help you secure your retirement while living in this beautiful Alpine nation.

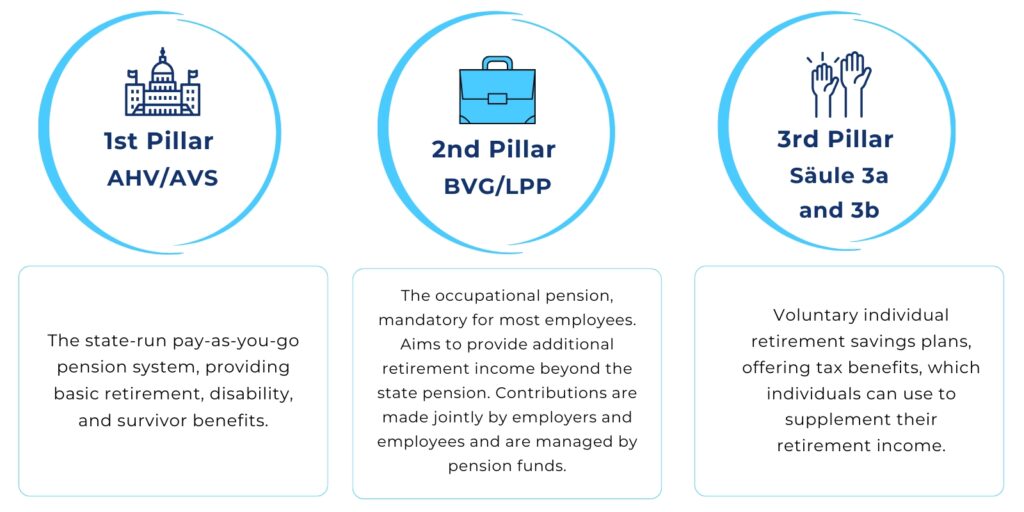

1. Understanding the Swiss Three-Pillar Pension System

Switzerland has a unique three-pillar pension system, comprising of the state pension (first pillar), occupational pension (second pillar), and voluntary private savings (third pillar). As an expat living in Switzerland, understanding how these three pillars work is essential. Start by finding out if your home country has a social security agreement with Switzerland, as this can impact your eligibility for state benefits. In addition, learn about the mandatory occupational pension, which is a critical component of retirement planning for residents.

2. Get to know your Swiss Second Pillar Pension

The second pillar of the Swiss pension system, the occupational pension, is typically funded jointly by employees and employers. Expats should strive to learn more about this pillar, because it can be an excellent asset to boost your retirement pot.

Pro Tip: If your adviser isn’t talking to you about voluntary contributions into your second Pillar at your annual review, I would ask them why.

3. Don’t forget to Invest

Investing wisely is a cornerstone of retirement planning. Diversify your investments across different asset classes to reduce risk and increase the potential for long-term growth. Consider working with a financial advisor who specialises in expat financial planning, as they can help you navigate the unique challenges and opportunities expats face whilst investing Switzerland.

4. Managing Global Assets as an Expat in Switzerland

As many expats have worked in other countries before settling in Switzerland, it’s crucial to stay on top of your pension statements from previous employment. Knowing when you can access a pension and how much it is forecasted to pay can play a key part in cashflow planning in retirement. Explore your international pension statements and consider how they fit into your overall retirement plan.

5. Why Expats in Switzerland Should Seek Financial Planning Advice

Retirement planning is not a one-time task; it’s an ongoing process. Stay informed about changes in Swiss pension laws and tax regulations that may affect your financial situation. Regularly review and adjust your retirement plan to ensure it aligns with your goals and circumstances. Start planning for retirement as early as possible; the sooner you begin, the more time your investments have to grow.

Secure Your Financial Future — Talk to a Swiss Expat Retirement Adviser

If you’re an expat living in Switzerland, make sure you follow these five retirement planning tips so that you can take proactive steps to ensure a financially secure and comfortable retirement.

For personalised guidance and to explore retirement planning services tailored to your unique needs, be sure to book your Free Introductory Meeting to learn how we can assist you in achieving your retirement goals.

Or to continue reading on this topic, download our e-guide ‘Plan Your Retirement with Confidence’ which answers these 5 key questions:

- How Much do I need to retire?

- What is the best retirement savings strategy?

- When should I start planning for retirement?

- Where does my income come from in retirement?

- How do I create a retirement plan?